Quarterly Summary - Q3 2025

The reporting period for the third quarter has now been summarized, and the picture is mixed. While revenue growth continues to come in slightly below expectations, there are clear signs that efficiency improvements are paying off and that companies are strengthening their margins. Below is an overview of the reporting season - the figures, the winners, the losers, and how the market has adjusted its expectations.

The summary is based on 293 companies that received at least 8 estimates on pinpointestimates.com.

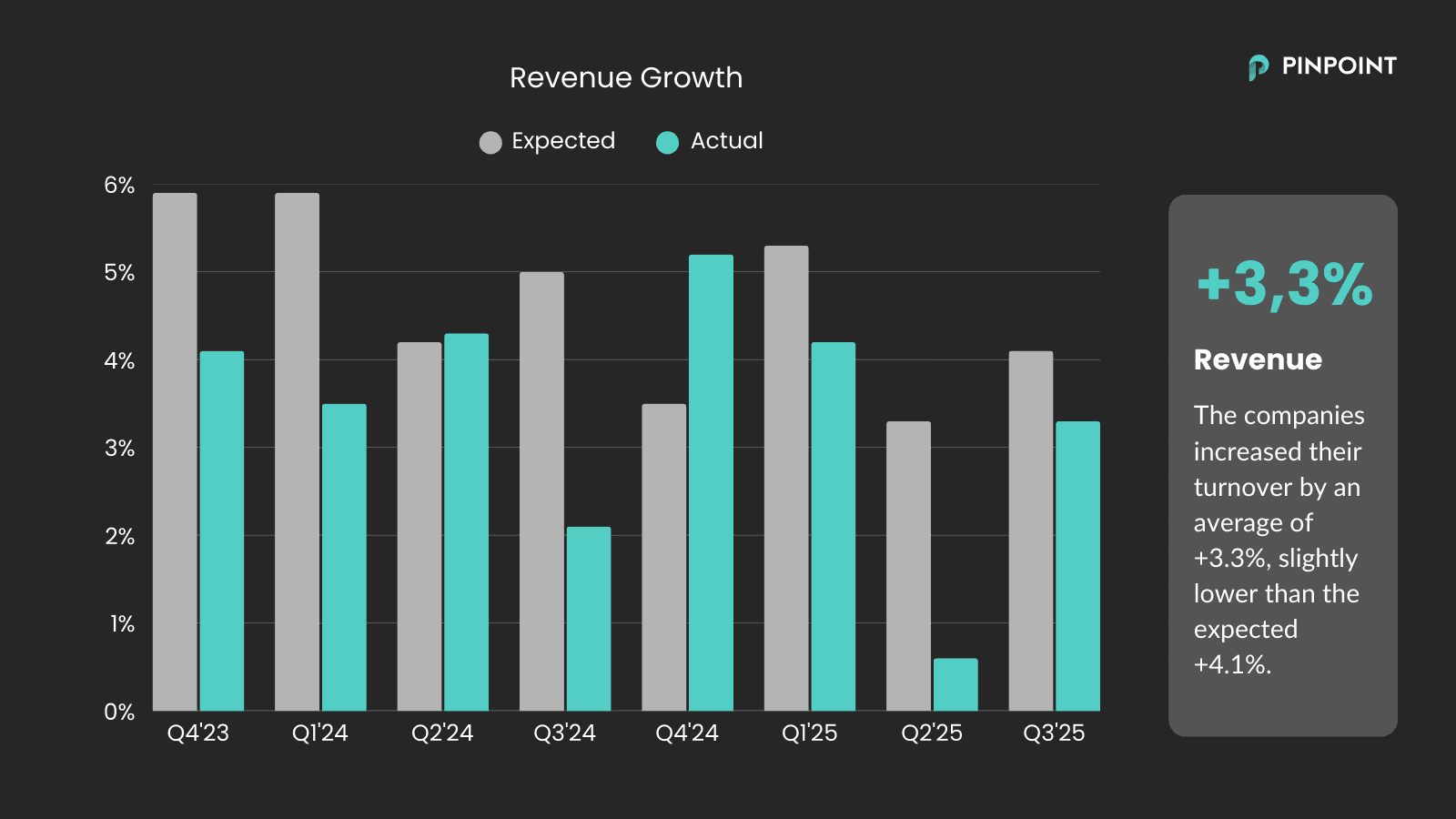

A Weak Recovery

Average revenue growth came in at +3.3%. This is an improvement compared to the weak +0.6% recorded in the previous quarter, but the figure should be viewed in the context of last year’s soft comparison quarter. The outcome fell short of the expected +4.1%, making this the third consecutive quarter in which growth has not met market forecasts.

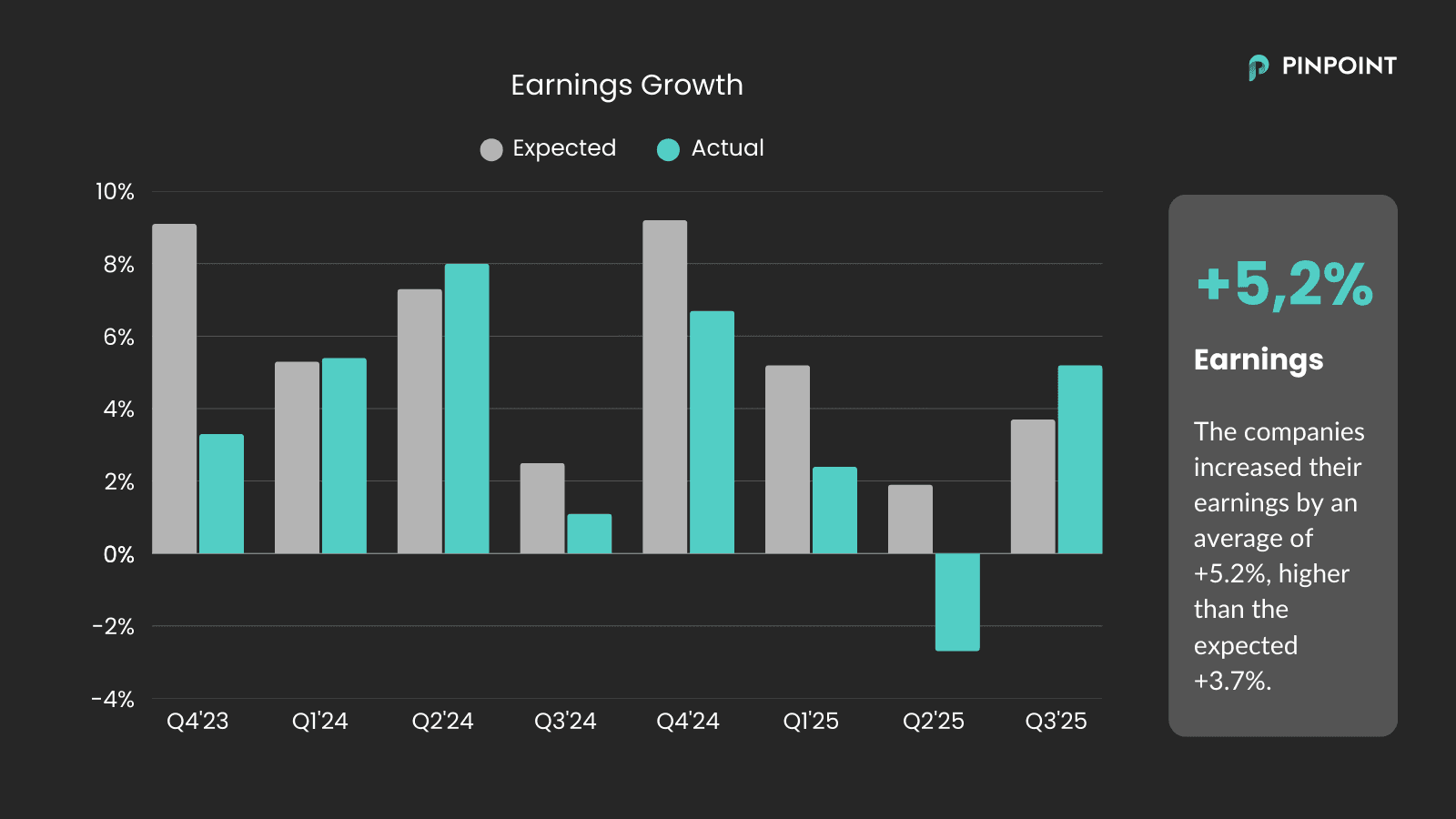

Margins are Strengthening

The outlook is brighter on the earnings side. Results increased by an average of +5.2%, exceeding the expectation of +3.7%. The fact that profits are growing faster than revenues indicates that companies have successfully strengthened their margins. The recurring theme of cost reductions appears to be delivering measurable effects. This marks a shift in trend, as this is the first quarter since Q2 2024 where earnings have outpaced expectations.

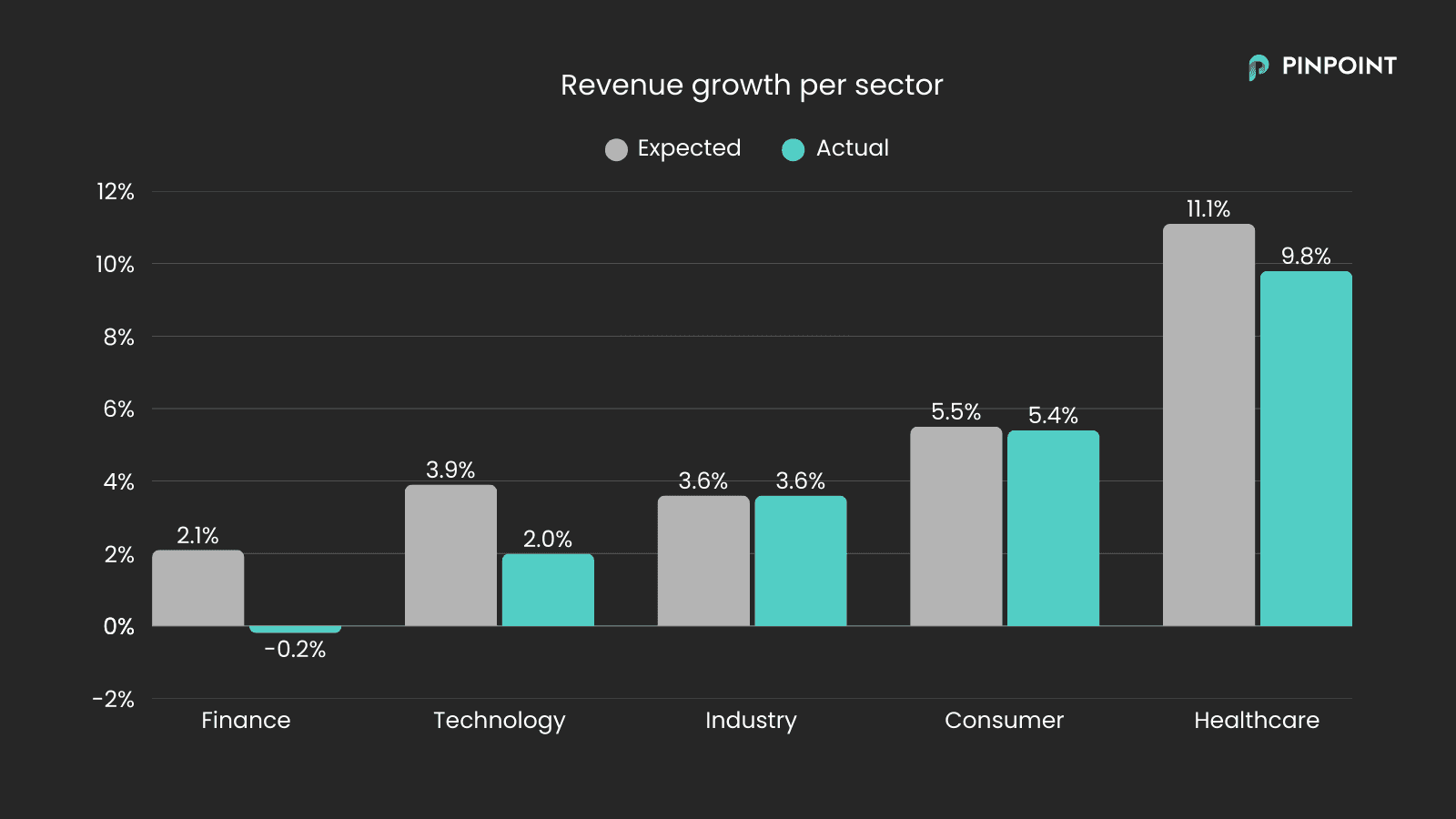

Healthcare Leading the Way

Breaking down growth by sector, Finance showed the lowest growth, with banks under pressure from declining net interest income. However, all sectors reported stronger growth than in the previous quarter, with Healthcare once again posting the highest figures.

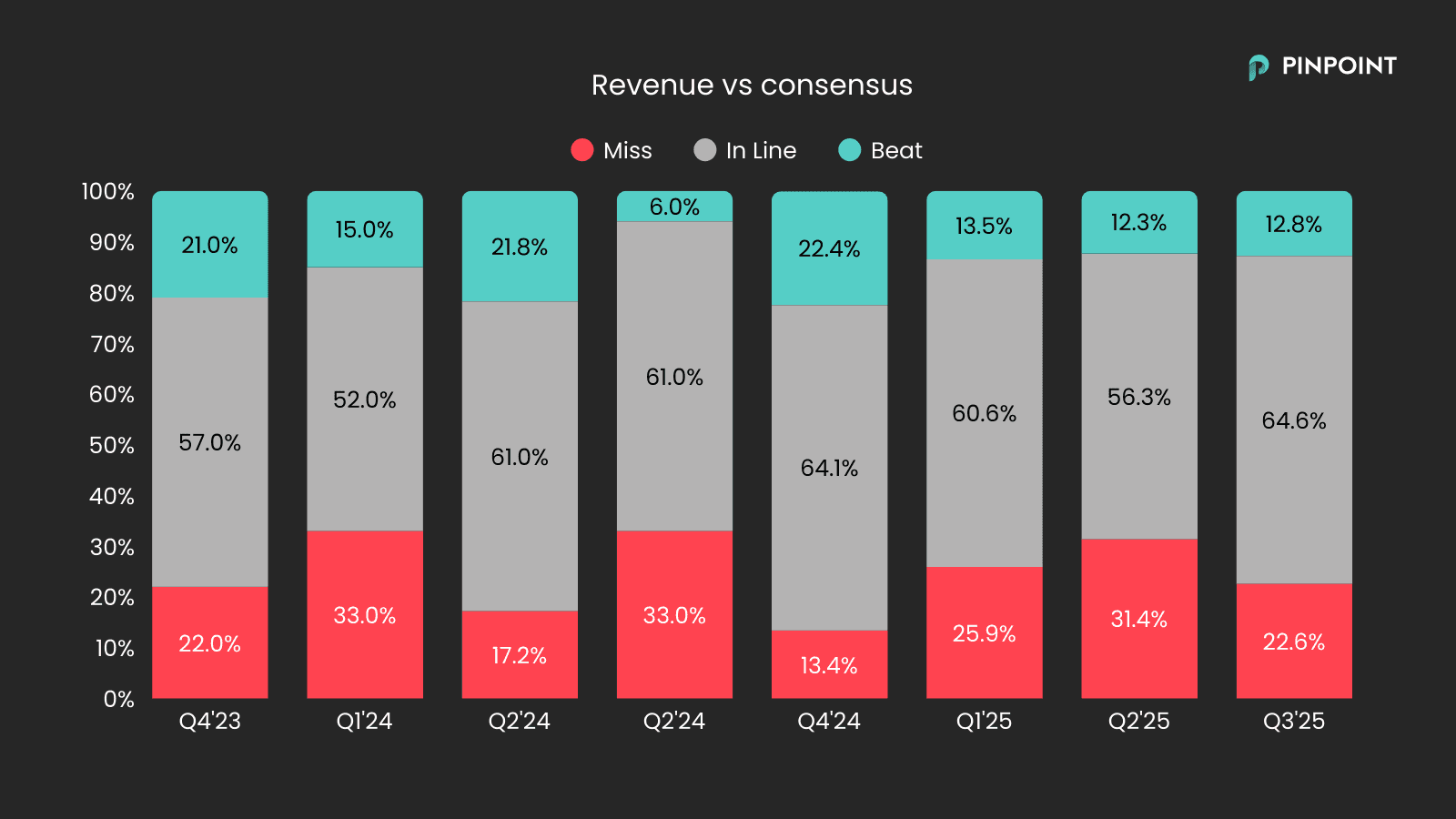

Revenue vs. Consensus

A majority of companies (65%) reported in line with expectations (defined as within ±5% of consensus). 13% exceeded forecasts, while 23% came in below. This represents a more stable picture than in recent quarters.

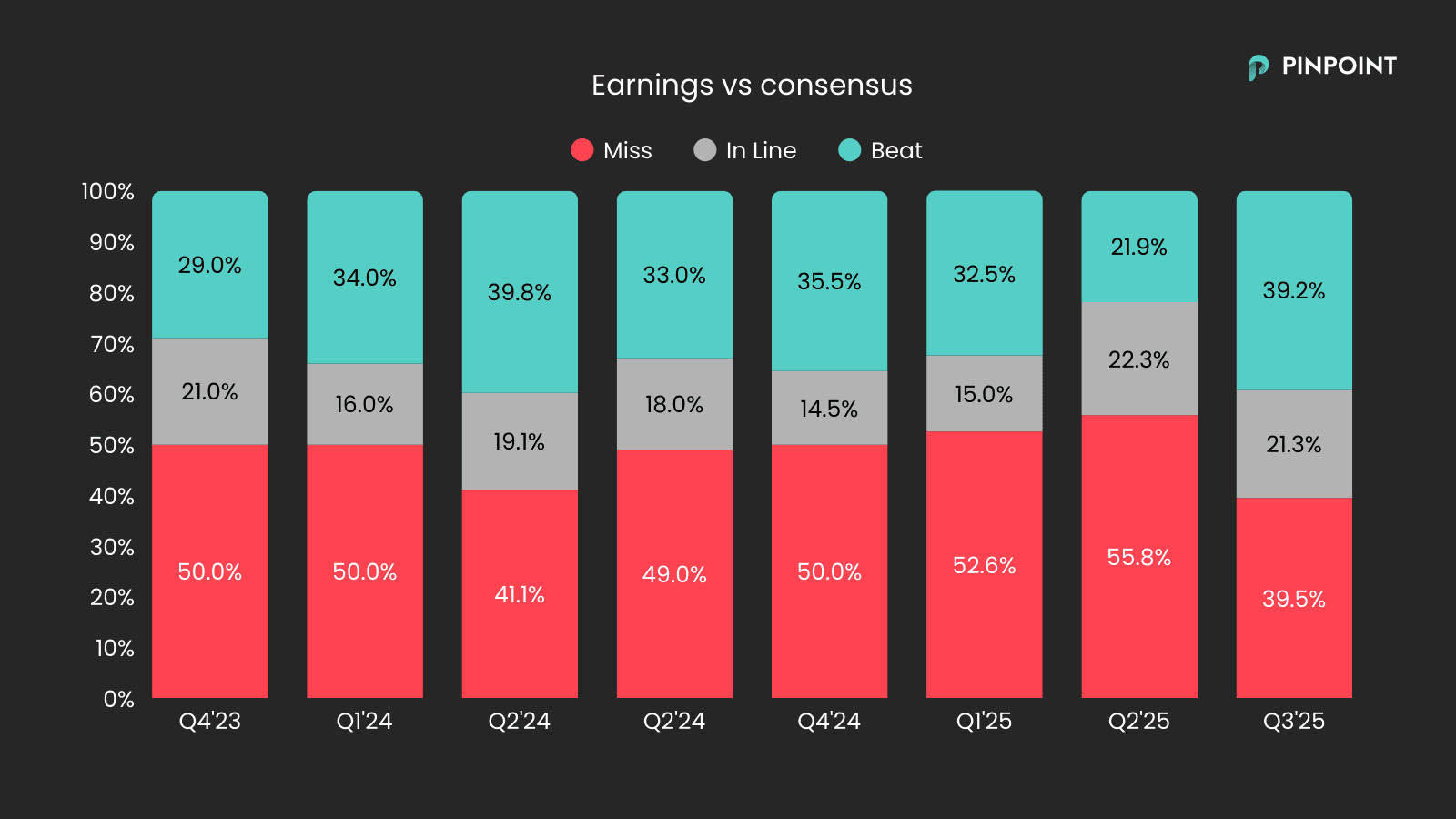

Earnings vs. Consensus

Earnings tend to vary more than revenue, and the dispersion was wider here. A full 39% of companies beat expectations - an unusually high figure. 21% reported in line with consensus, while about 40% missed.

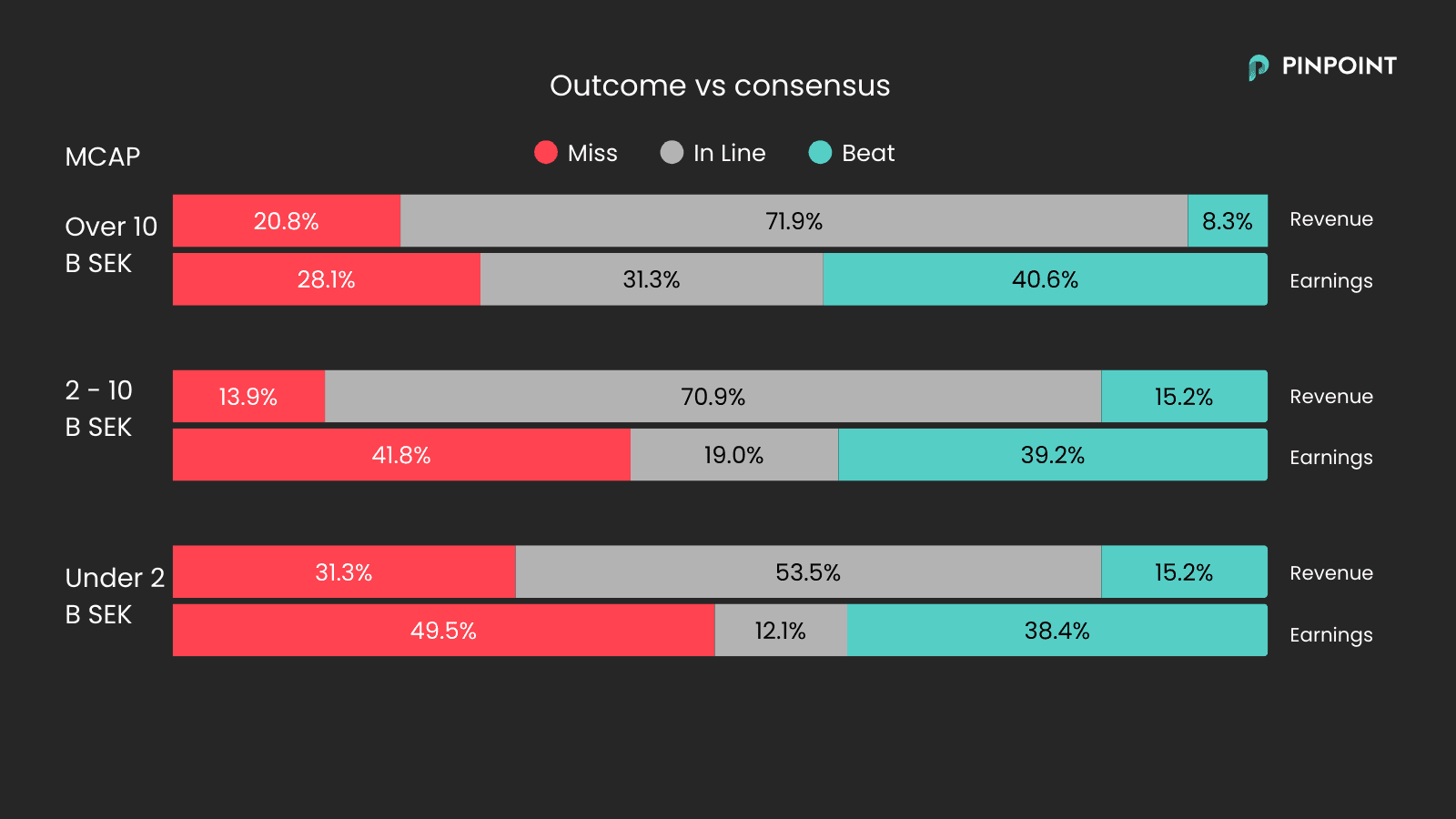

Outcome vs. Consensus by Company Size

Looking at company size, we see an interesting deviation among the largest companies (>10 B SEK in market cap). Only 8% of these beat revenue expectations, but a full 41% surpassed profit forecasts. Smaller companies were, as usual, more difficult to predict.

Report Winners of the Quarter

Company | Share Price Reaction | Revenue Beat/Miss | Earnings Beat/Miss | |

1. | Volvo Car | +38,1% | +2% | +153% |

2. | Zinzino | +25,2% | -3% | +36% |

3. | Harvia | +22,5% | +7% | +11% |

4. | Prevas | +22,1% | 0% | +31% |

5. | Raysearch | +21,9% | +3% | +44% |

Report Losers of the Quarter

Company | Share Price Reaction | Revenue Beat/Miss | Earnings Beat/Miss | |

1. | 4C Group | -30,0% | -12% | N/A |

2. | BTS Group | -21,2% | -4% | -31% |

3. | Lammhults | -20,5% | +6% | -17% |

4. | Balco | -20,4% | -15% | -70% |

5. | Truecaller | -18,4% | -7% | -9% |

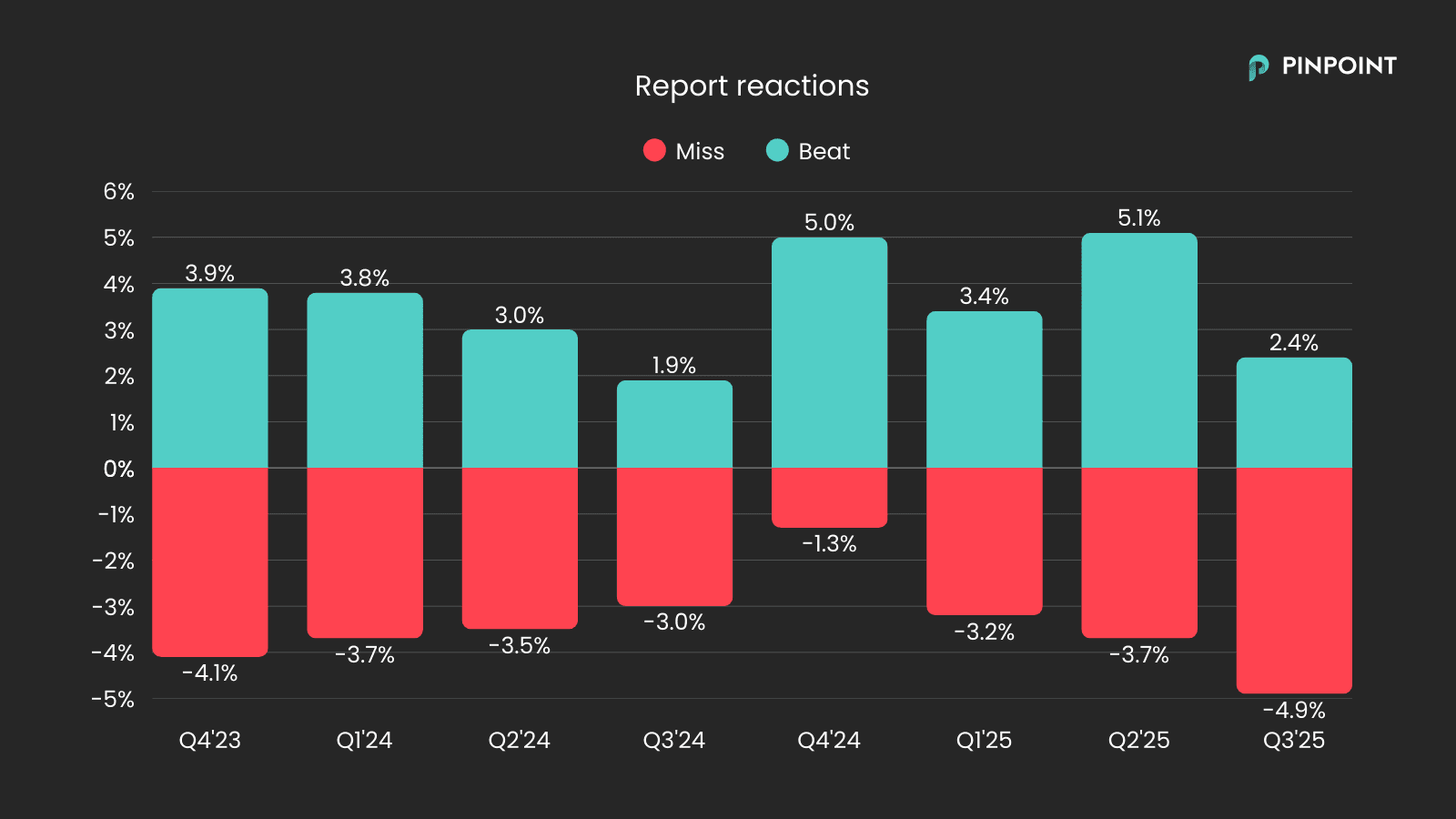

Market Response to Results

Sentiment during the period has been clearly negative. Companies that missed expectations were penalized significantly - on average -4.9% - while the reward for strong reports was limited to +2.4%. This is the third consecutive quarter where negative reactions are amplified, and positive reactions remains muted. The question now is whether we are approaching a turning point - or whether the trend will continue?

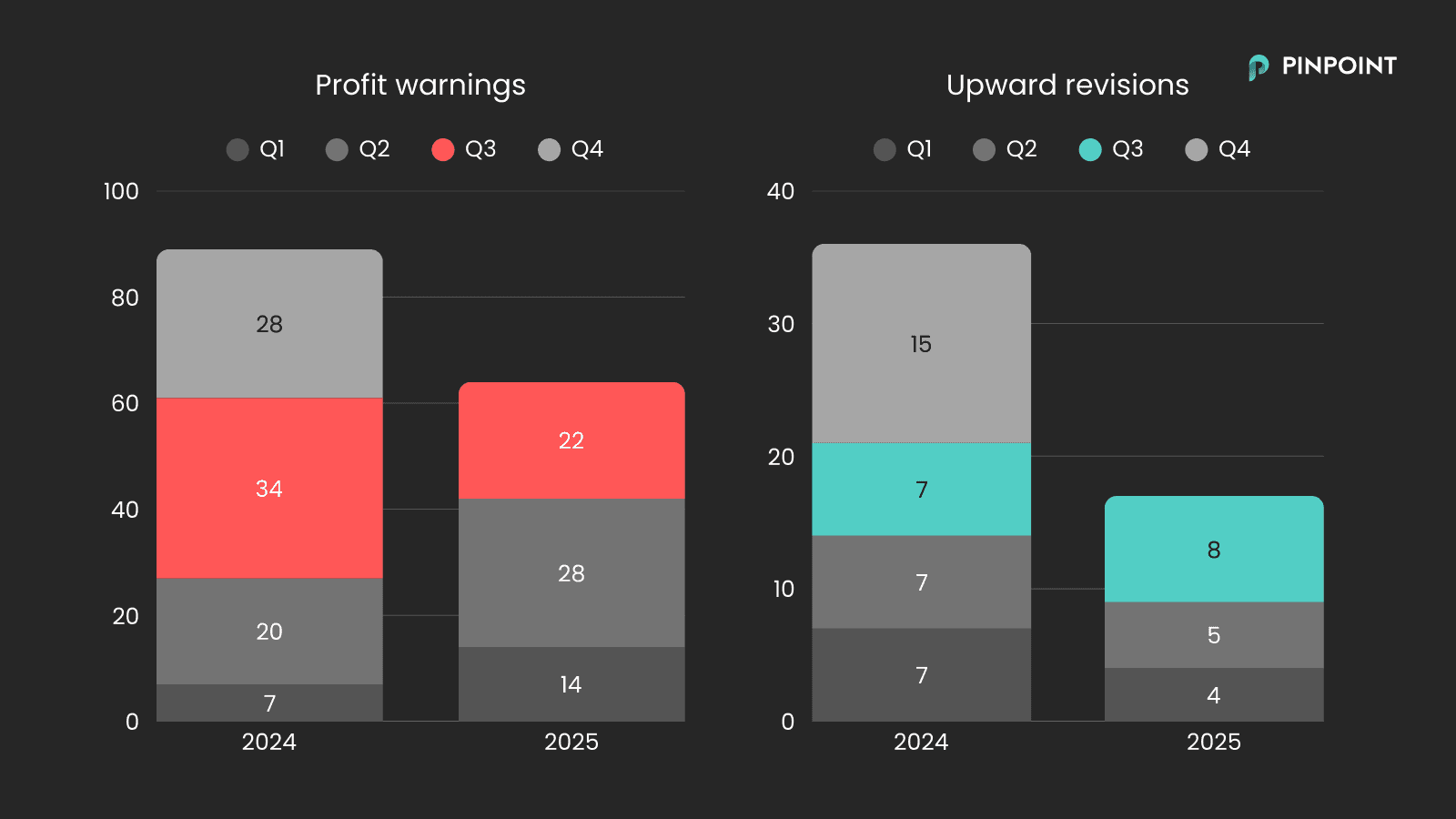

Profit Warnings

During the first two reporting periods of 2025, the number of profit warnings was higher than the previous year. The Q3 season, which historically tends to include many warnings, was somewhat calmer this year, with fewer warnings than last year. Upward revisions remained fairly stable.

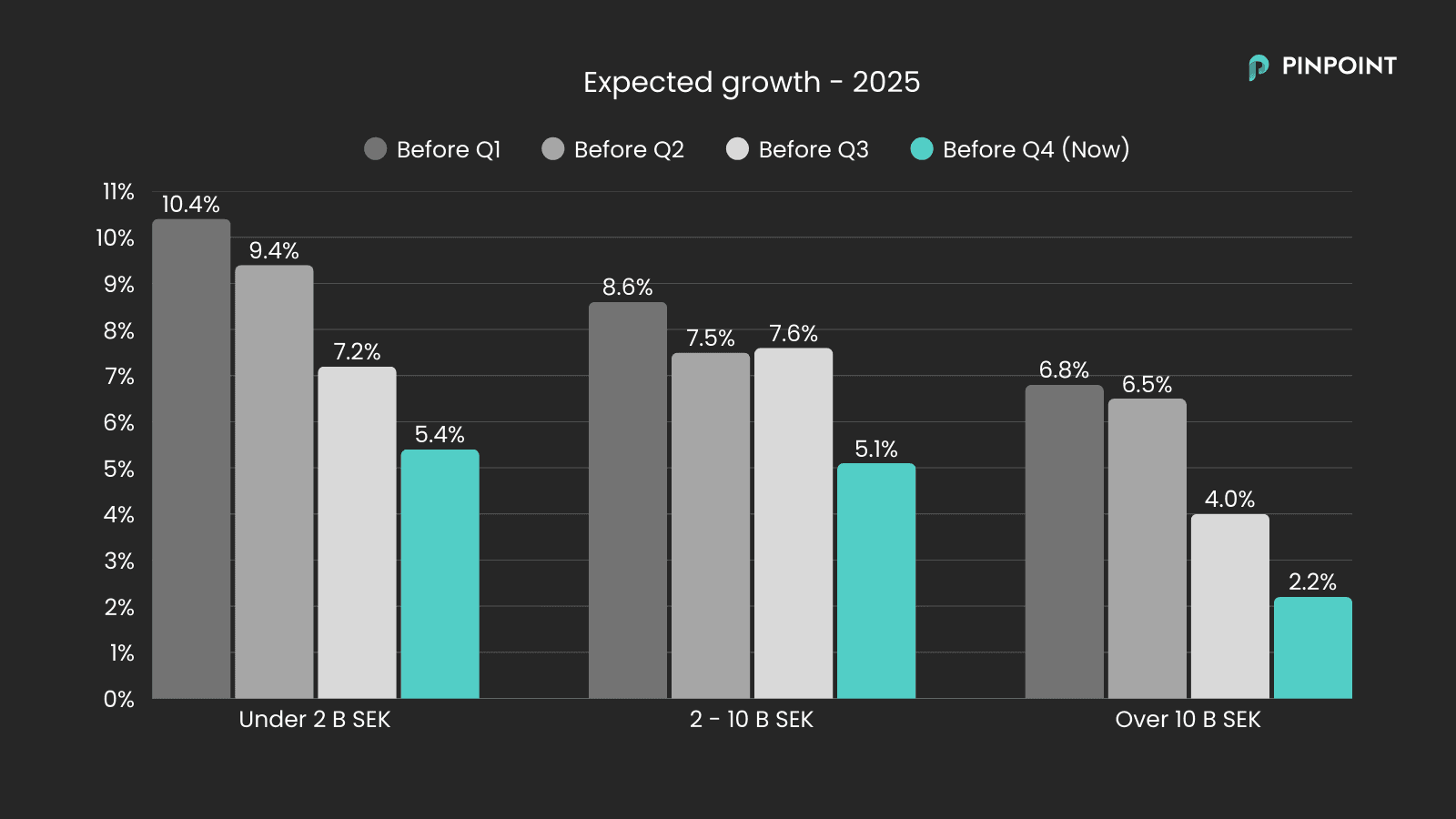

Growth Expectations for 2025

Ahead of 2025, investors had anticipated a recovery. However, those expectations have been gradually lowered after each reporting period. With only Q4 remaining, we are now heading towards a year of modest growth: just above 5% for the smallest companies and 2% for the largest.

Is the stock market a winter sport? It is often said that the stock market performs better during the winter months. Perhaps this is related to what the chart above illustrates: as the year draws to a close, the market increasingly looks toward the next year - and expectations for the coming year are usually quite optimistic?

Thank you!

Thank you for helping create a clearer expectations landscape for hundreds of listed companies by submitting estimates throughout the quarter. Visit Pinpoint to stay up to date on the latest expectations ahead of upcoming quarterly and full-year reports.