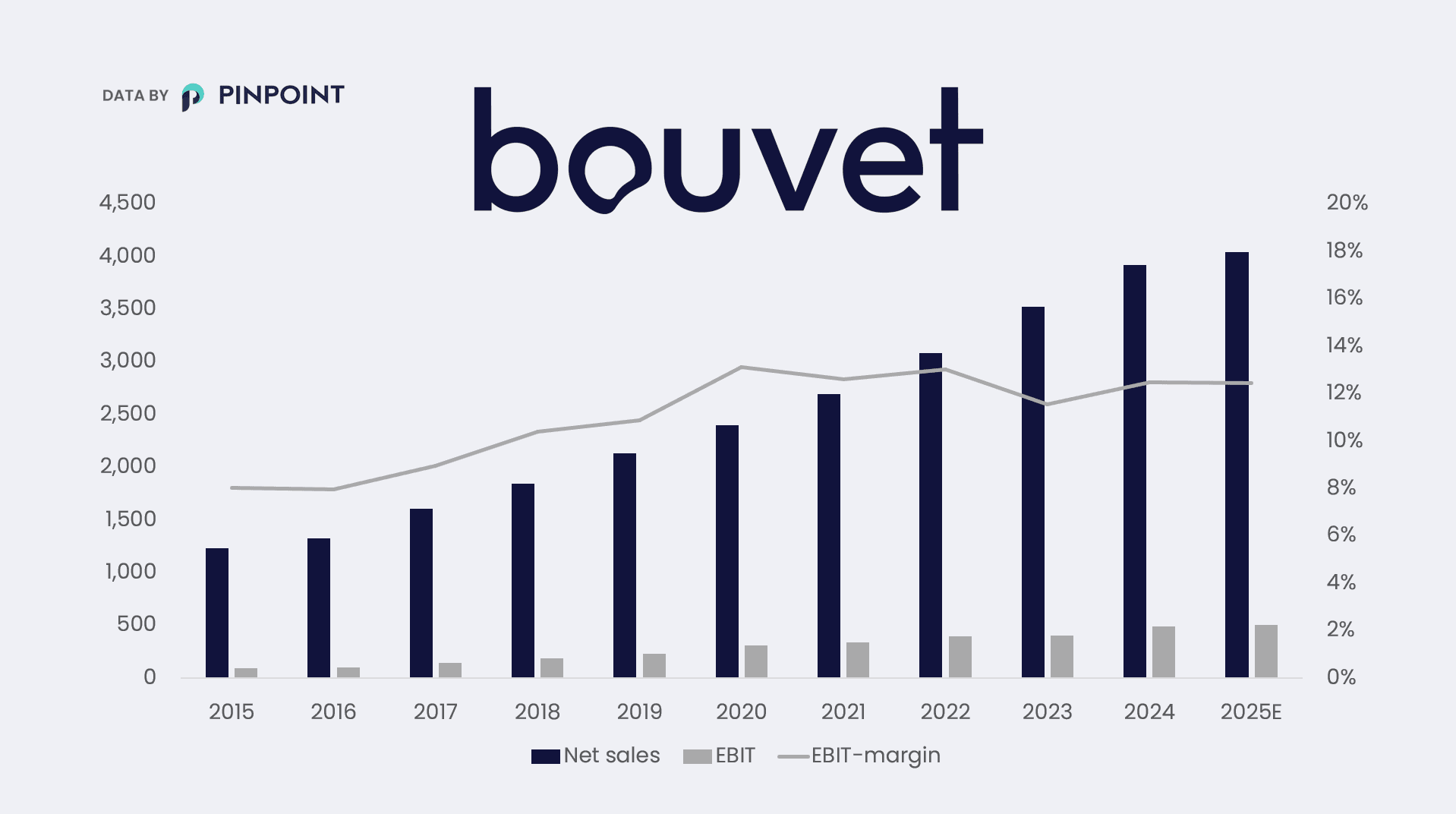

Bouvet – temporary setback or start of a new trend?

Over the years, Bouvet has demonstrated remarkable stability in both growth and profitability. The first half of 2025, however, has proven more challenging. In the second quarter, the company reported its first negative revenue growth since 2016 – a development that has worried investors. The share price is down roughly 16% year to date. The key question now is whether this is a lasting slowdown, or merely a temporary setback.

Bouvet’s financial track record is impressive. Over the past decade, the company has achieved an average annual revenue growth of +12%, and +10% over the past five years. This growth has come with improving profitability – the operating margin has risen from around 8% to as high as 13%. Over the past five years, the average margin has been 12.5%, highlighting strong operational efficiency.

Bouvet provides IT, design, and advisory services that help clients develop digital solutions to improve efficiency. The customer base is dominated by the public sector, which accounts for 53% of revenue. Clients within oil, gas, and renewable energy are important, representing nearly 40% of total sales.

So far in 2025, growth has been modest. Revenue increased by only +1% in the first half of the year, while operating profit rose +3%. Despite higher revenue per billed hour, growth has been held back by a lower utilization rate and a stagnant consultant base. Given the current market environment – and in comparison with peers – Bouvet’s performance remains solid.

Looking ahead to the second half, the market expects muted growth but stable margins. Based on Pinpoint Consensus for 2025E, the stock trades at EV/EBIT 13.2, above many other consulting peers. However, Bouvet may well deserve a premium valuation given its consistent performance. Compared to its historical average of EV/EBIT 16, the stock appears attractively priced.

Will performance stabilize in the coming quarters – or is this the start of a longer downturn for Bouvet?

Ahead of the Q3 report on November 11, 16 investors have submitted their expectations for revenue and profit. See what other investors and analysts expect before the report on Pinpoint: