Equity Insights by Pinpoint - Nelly Group

The Company – From Then to Now

The company as it exists today has not always looked the same, but has gradually developed and changed over time. So how did it all begin?

In 1999 the e-commerce company CDON.COM was launched, which quickly became a success and laid the foundation for what later would develop into today’s Nelly Group. CDON then began to acquire other companies and build a portfolio of various e-commerce businesses.

Nelly was launched in 2004 and acquired by CDON.COM three years later. Until 2014 the company focused on fashion and accessories for women, but that same year the offering was broadened with menswear through a separate initiative under the name NLY Man. In parallel, the group also founded Qliro Financial Services, which developed payment solutions for both the group’s own companies and external e-commerce players. The purpose was to create a more efficient payment infrastructure while capitalizing on the rapidly growing online market.

From 2017 the group — then called Qliro Group — was structured around three business areas: Qliro Financial Services, CDON Marketplace and Nelly.

In 2018 it was decided that these businesses should be transformed into independent companies, and the restructuring began. During the second half of 2020 the plan was completed: Qliro AB was spun off and listed as an independent company, followed by CDON somewhat later the same year. When these spin-offs were completed the remaining business changed its name to Nelly Group AB — the name the company still uses today.

The Company’s Operations

Nelly Group sells fashion and accessories to young women and men through the e-commerce platforms Nelly.com and NLYMan.com. The company’s sales consist of own brands and a selection of external brands, and are conducted mainly digitally but also via its flagship stores in Stockholm and Copenhagen. By targeting consumers directly, Nelly can build a strong brand, close customer relationships and quickly capture trends in the target group.

The business model is based on a direct-to-consumer strategy where the company handles large parts of the value chain internally — from design and purchasing to marketing and logistics. Own assortment accounts for a significant part of sales (62.2% share in Q3’25), which contributes to good margins.

The business is centered in Borås, where the company’s modern and automated logistics center is also located. This enables efficient warehousing and fast deliveries. Marketing is carried out mainly via digital channels and social media, which creates direct contact with the target group and contributes to cost-efficient customer acquisition.

Financial History

After the transformation described above, the company was ready for development and initiated a number of structural initiatives to improve profitability and strengthen its market position, of which the first were started shortly thereafter.

During 2021–2022 the focus was on building an efficient and scalable operation. The company consolidated its logistics by centralizing warehouse operations to a new, automated distribution center in Borås — an investment intended to improve delivery accuracy and reduce costs over time. At the same time, marketing costs were reduced, the organization was streamlined, and the share of sales from own brands increased, which contributed to an improved gross margin. The improvement work had now begun and would continue.

A central part of the initial improvement effort was to change the assortment strategy. Historically Nelly had offered a broad range of both external brands and own products in many colors, sizes and models — something that led to large inventories and a high risk of unsold items, which pressured both margins and return rates. During the first years of the transformation the company therefore initiated work to reduce the number of external brands and steer the in-house collections toward fewer, more volume-driven models. The goal was to reduce inventory ties and create better conditions for a lower return rate and a higher share of sales from own brands, which together would lead to improved profitability.

During 2023 the effects of the transformation became clearer. Despite reduced revenue, profitability improved markedly. Gross margin rose to 47.9% (from 43.6% in 2022) and the company reported a positive operating result for the first time in several years. The company communicates that the improvement was driven by a higher share of own brands, more efficient purchasing processes and lower logistics costs — entirely in line with the initiatives it has taken and implemented.

With only one report left to publish for 2025 we can conclude that development has continued in the right direction. For 9M 2025 the company has achieved revenue growth of 15.1% while at the same time increasing the operating margin from 7.3% to 13.3%. Behind this are improvements in several areas:

- Warehouse and distribution costs as a share of net sales have decreased to 11.7% from 17.7%

- Marketing costs as a share of net sales have decreased to 9.8% from 11.0%

- Return rate has decreased to 26.7% from 34.8%

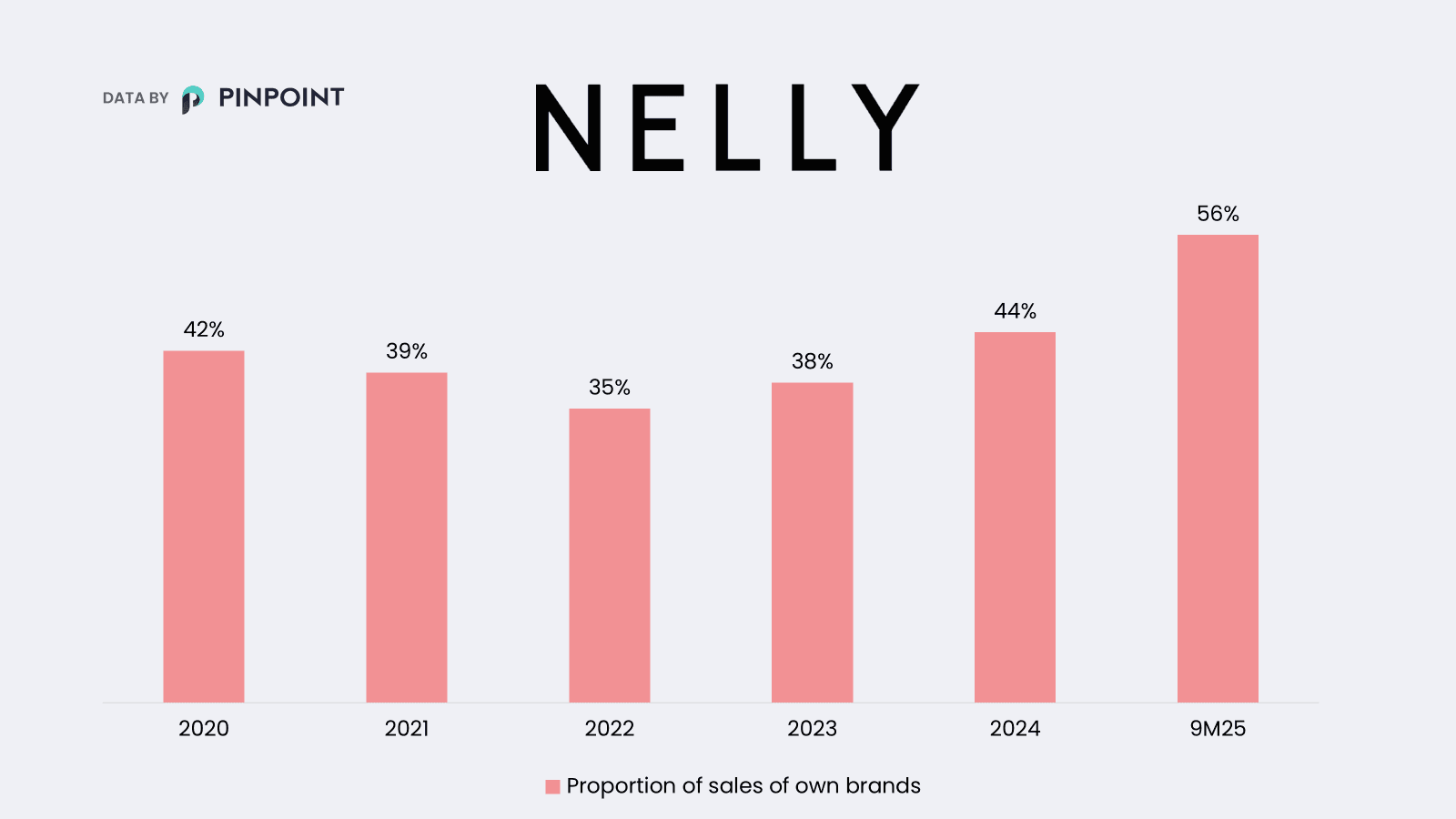

- Share of sales from own brands has increased from 39.4% to 55.8%

2021 | 2022 | 2023 | 2024 | 9M25 | |

Warehouse and distribution costs as a share of net sales | 17,7% | 15,8% | 16,1% | 13,1% | 11,7% |

Marketing costs as a share of net sales | 11,0% | 11,4% | 9,5% | 10,7% | 9,8% |

Return rate | 34,8% | 36,0% | 35,8% | 29,9% | 26,7% |

Share of sales from own brands | 39,4% | 35,1% | 38,2% | 44,2% | 55,8% |

Through lower operating costs, increased sales of higher-margin own brands, and reduced return rates, Nelly Group has shown strong financial and operational improvement, attracting increased investor interest.

Whether this momentum will hold over time remains to be seen—but the company stands significantly stronger than just a few years ago.

Ownership Structure

The largest owner in Nelly Group AB is Rite Ventures, which holds just over one third of the shares in the company. Rite Ventures is a Swedish investment company that invests primarily in technology and e-commerce. In addition to Nelly, the company has among others Söder Sportfiske, Modular Finance and Verkkokauppa.com as large holdings. The second largest owner is Stefan Palm, founder of Lager 157, who holds about 17% of the shares.

Among other larger owners are for example institutional investors such as Mandatum Life Insurance Company (5.8%), Handelsbanken Funds (1.7%) and eQ Asset Management (1.5%). Together, the ten largest owners control 71.1% of the shares in Nelly Group AB.

Top 10 largest owners | Owner share |

Rite Ventures | 34,0% |

Stefan Palm | 16,7% |

Mandatum Life Insurance Company | 5,8% |

Avanza Pension | 3,9% |

Nordnet Pensionförsäkring | 2,3% |

Klas Bengtsson | 2,2% |

Nelly Group AB | 1,7% |

Handelsbanken Fonder | 1,7% |

Alexander Eskilsson | 1,5% |

eQ Asset Management | 1,3% |

Topp 10 | 71,1% |

Estimates & Valuation

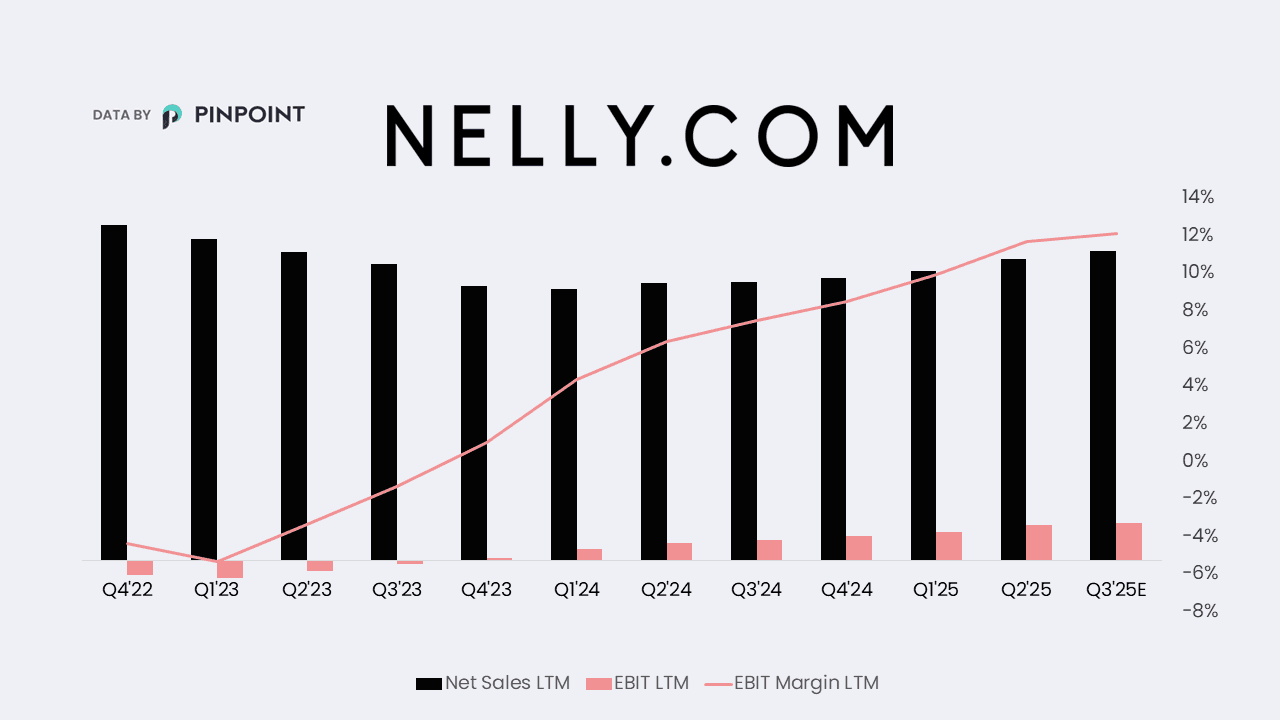

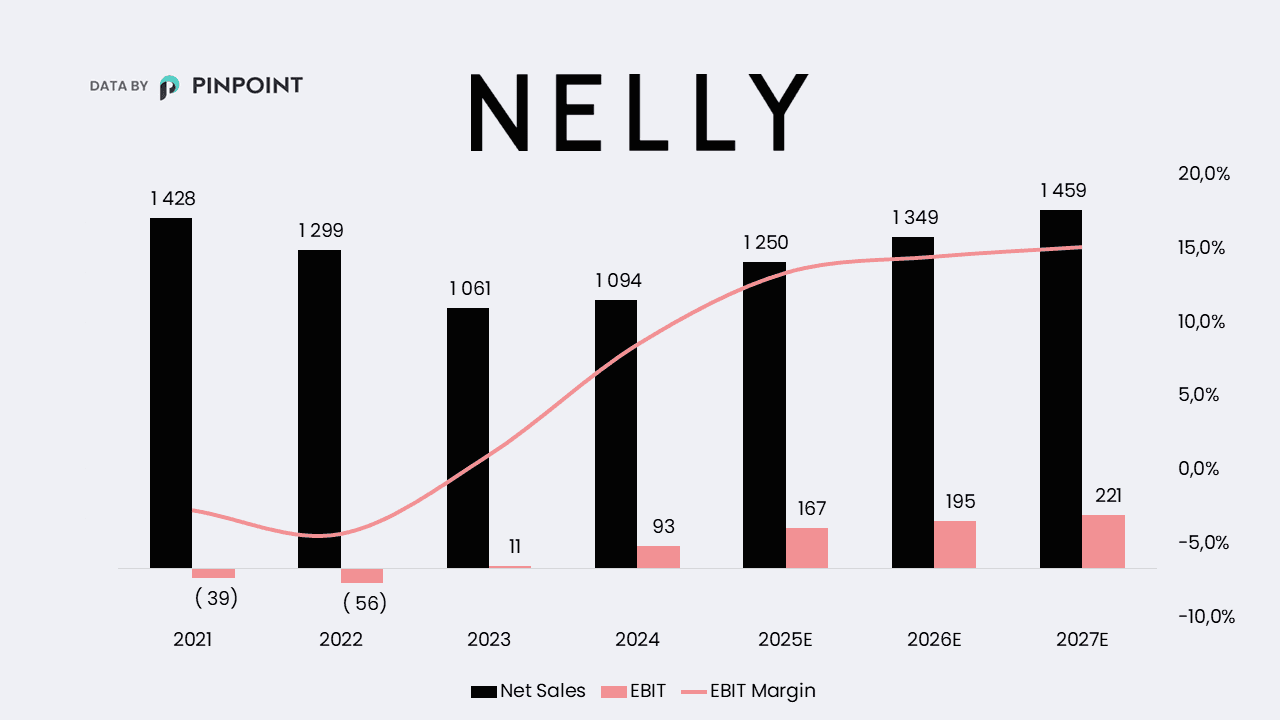

After several years of restructuring and efficiency improvements, Nelly Group has gradually turned weak profitability into a clearly improved result. The year 2024 marked a clear trend reversal. The company reported an EBIT margin of 8.5% (from 1.0% the year before) and growth of just over 3%, confirming the effects of recent years’ efficiency programs. Behind the improvement were among other things lower inventory and distribution costs, falling return rates and higher sales of products from own brands.

Looking forward, investors expect Nelly to continue to strengthen both growth and margins. For 2025–2027 an annual growth of around 8–12% is estimated and a gradually rising operating margin above 14%. The market currently values the company at an EV/EBIT multiple of approximately 18x for 2025, reflecting growing confidence in the company’s new, more scalable business model and ongoing profitability journey.

Millions SEK | 2022 | 2023 | 2024 | 2025E | 2026E | 2027E |

Net sales | 1 299 | 1 061 | 1 094 | 1 250 | 1 349 | 1 459 |

Growth % | -9,1% | -18,3% | 3,2% | 13,7% | 7,9% | 8,2% |

EBIT | -56,1 | 10,9 | 93,1 | 167,3 | 195,4 | 220,8 |

Margin% | -4,3% | 1,0% | 8,5% | 13,4% | 14,5% | 15,1% |

EV/EBIT* | 18,2 | 15,6 | 13,8 |

*EBIT based on Pinpoint consensus for 2025-12-09. Enterprise value 3 053 MSEK (per 2025-12-09) with net debt including leases.

Q4 Report – 10 February

On 10 February Nelly publishes its fourth and final report for this financial year and ahead of the report the company is expected to continue to develop in the same direction as recent years. The expectation is that it will show double-digit growth and clear margin improvements compared with the previous year. Submit your estimate to see others’ expectations and the consensus ahead of the report:

Would you like to learn more about the company? Read more on their IR page: